- BLUE HELP

- Blueprinting Center & Methodology

- How does Blueprinting fit with Minesweeper de-risking?

-

Blueprinting Center & Methodology

- What is New Product Blueprinting?

- How is Blueprinting learned and applied?

- Blueprinting Center

- Blueprinting E-Learning Course

- How can I become Certified in New Product Blueprinting?

- How does Blueprinting fit with a stage-and-gate process?

- How does Blueprinting fit with strategic planning?

- How does Blueprinting fit with Design Thinking?

- How does Blueprinting fit with Lean Startup?

- How does Blueprinting fit with Minesweeper de-risking?

- How does Blueprinting fit with LaunchStar product launch?

- What innovation metrics should we use?

- What is "Jobs-to-be-Done?"

-

Blueprinter® Software

-

Market Segmentation (Step 1)

-

Discovery Interviews (Step 2)

- How to plan Discovery interviews

- Preparing your interview team

- Convincing customers to be interviewed

- How to handle confidential info in an interview

- How to conduct a Discovery interview

- Finding & using a digital projector for interviews

- How to conduct a customer tour

- How to debrief & follow-up a Discovery interview

- Engaging your sales colleagues in interviews

- Engaging distributors in interviews

- Interviewing customers down the value chain

- How to interview remotely with web-conferences

- How to interview at trade shows & other venues

- Interviewing in different global cultures & languages

- How to listen well during customer interviews

- How to probe during customer interviews

- How to gather economic data during interviews

- How to create & use Current State questions

- How to identify Must Haves (MH)

- How to select Top Picks (TP)

- How to use Trigger Maps

- How to form Outcome Statements

-

Preference Interviews (Step 3)

-

Rest of Blueprinting (Steps 4-7)

-

Everyday VOC

-

Minesweeper® De-risking

1. Developing products for unfamiliar markets

Removing fear from the "new-new" quadrant of the Ansoff matrix

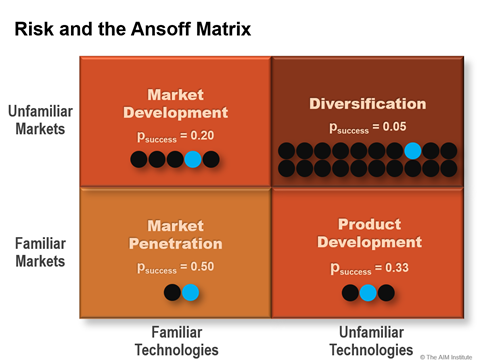

How often has your company developed a great new product for an unfamiliar market? If you’re struggling to think of many examples, you’re not alone: Success rates are typically very low. You’re probably familiar with the Ansoff Matrix: While success rates are low when pursuing unfamiliar technologies (right side of matrix), they get much worse for unfamiliar markets (top of matrix).

To position your company for routinely developing blockbuster products, you’ll need to change your thinking. First, stop thinking of unfamiliar markets as “new” markets.

In most cases, your target market isn’t really “new.” We prefer the term “unfamiliar” market instead of “new” market: Many B2B companies call a market “new” when in fact they mean, “new to us.” This strikes us as supplier-centric—not customer-centric—thinking. The market was there first. It is the supplier that is new.

This is good news because it means you don’t have to live with uncertainty. Customers in these pre-existing markets are very certain about much you need to learn. And these B2B customers—rich in knowledge, interest, objectivity and foresight—can eliminate your uncertainty. In a Discovery interview, “unfamiliar market” contacts can give you every bit as much valuable information as those in markets you’ve supplied for 30 years.

This is good news because it means you don’t have to live with uncertainty. Customers in these pre-existing markets are very certain about much you need to learn. And these B2B customers—rich in knowledge, interest, objectivity and foresight—can eliminate your uncertainty. In a Discovery interview, “unfamiliar market” contacts can give you every bit as much valuable information as those in markets you’ve supplied for 30 years.

For more on this topic, download our white paper, Innovating in Unfamiliar Markets, and view the Minesweeper Project De-risking video.

In the next 4 articles, we’ll explore…

- Why uncertainty is different than risk

- Locate landmines early and cheaply

- Minesweeper de-risking methodology

- Where Blueprinting fits with Minesweeper de-risking

Keywords: risk, uncertainty, Ansoff matrix, unfamiliar market, new market, new technology, Minesweeper, de-risking, landmine, project