2. The B2B Index: “How B2B” is your market?

AIM's "B2B Index" helps you understand the B2B nature of your market... and how to use this information.

It can be an over-simplification to think in blunt terms of B2B vs. B2C… and even misleading. If someone from your office buys a new paper stapler, it’s technically a B2B purchase… but their level of knowledge, interest, objectivity, etc. might be quite low. If you’ve been planning on buying a sports car—a B2C purchase—you might be very knowledgeable and interested, for instance.

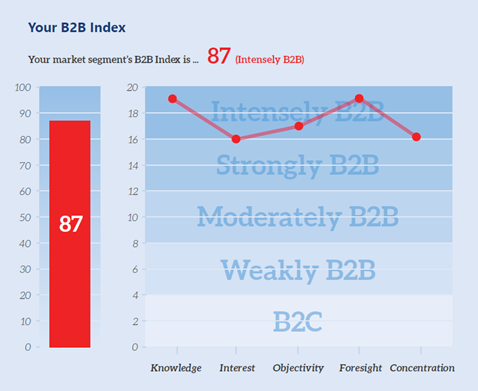

That’s why The AIM Institute developed the B2B Index, which tells you “how B2B” your market is. This is a free service anyone in your company can use at www.b2bmarketview.com. There you’ll answer 17 questions, to reveal how much knowledge, interest, objectivity, etc. the key decision-makers and decision-influencers have in your target market segment.

This tool then delivers a chart showing your B2B Index sub-scores for the five characteristics, as well as an overall B2B Index. The closer you are to 100 the “more B2B” your market is, and closer to zero, the “more B2C” it is.

The higher your markets' score, the greater your engagement potential. This means you will be able to learn more from them. It also means you can get them more excited about the product development work you're doing... so when you are ready to launch your product, they'll be very interested in it.

If you are responsible for several market segments, each will likely have a different profile. Also, this tool can be used for ongoing marketing work such as product launches, not just customer insight in the front end of innovation.

For more on the B2B Index, check out the 2-minute video, Put your B2B advantages to work, part of the B2B Organic Growth video series by Dan Adams.

Keywords: B2B index, B2B marketview, B2B, business to business, B2C, business to consumer, engagement potential