8 Suggestions for conducting Parts 2-to-5 in Preference interviews.

You may not have enough time to complete the rest of the Preference interview after Part 1: Outcome Ratings. But if you can, try to capture customer input on the second most important area: Part 2: Measuring Outcomes.

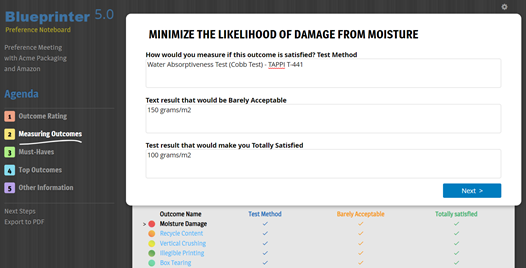

This is especially important if you think your project might proceed to Blueprinting Step 4: Side-by-side testing. New Product Blueprinting is unique in that this testing is highly customer-centric. That’s because you use Part 2 of the Preference interview to understand a) how customers measure the extent to which an outcome is being satisfied, and b) at what points—using this measurement—the outcome is barely satisfied and totally satisfied.

Interview teams—and their customers—are sometimes stumped here. Maybe the outcome is something that has no established “test method,” e.g. time needed to properly train operators. That’s OK, just ask them for two scenarios: “Please describe for me a scenario in which you were totally satisfied with operator training time.” “And what would it look like if operator training time was just barely acceptable.”

Take some pressure off yourself: You don’t need to create the final test method during the interview. Just learn as much as you can about how customers measure this outcome. This will be crucial in helping you replicate their experience in your own lab or operation later.

Here are a few other tips for the balance of your Preference interview:

- Identify the test expert: You may run out of time to fully explore the test methods in Part 2. If so, learn who the most knowledgeable customer contact is… and ask if you can contact this person later with a follow-up phone call.

- Record the details: If the customer is describing their test procedure, probe well and record as many details as you can. Sometimes effectively duplicating someone else’s test method hinges on what seemed like the smallest of details… so capture them here.

- Confidential test methods: What if the customer says, “We can’t divulge our test method for this… that’s our ‘secret sauce.’” You might respond along these lines: “We understand completely: Can you at least give us some simple “directional” test we might run ourselves? We just don’t want to guess at what you need and lob worthless samples/prototypes at you later.”

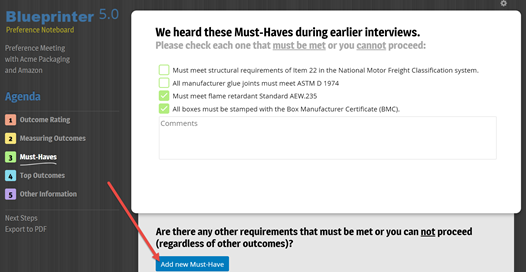

- Part 3: Must Haves: In this section, you’ll display the Must-Have outcomes that your team processed in Blueprinter Tool 3.1. Be sure the customer understands that a Must-Have is an outcome that must be met… or they cannot proceed. Place a check-mark on the outcomes customers identify as such. You’ll see there is also a place at the bottom of this page for the customer to add any Must-Haves that you might have overlooked.

- Top 3 Outcomes: Here you ask customers to identify their top 3 outcomes… the ones they would most like to see you improve. These can be selected from a drop-down menu, and each of the three outcomes is followed with these questions: a) What is the primary benefit of this outcome? b) How aggressively should we pursue this outcome? c) Why is this outcome important to you? Asking these questions will give you more insight into the value customers see for improving each outcome. (Their responses will be used to populate the Outcome Value "Heatmap" charts later in Blueprinter Tool 3.6.)

- Internal cross-check: When customers select their top 3 outcomes (above), you’d expect them to select outcomes that are both important and currently unsatisfied. This means they will likely be choosing outcome bubbles in the upper-left of the chart that you are displaying. If this is not the case, it’s fair to ask them, “Can you help me understand why you picked this outcome? It didn’t seem to be too important earlier.” (Or... "It seemed you were already satisfied with this.")

- Benchmark Products: This is the first half of Part 5: Other Information. In some industries, customers are reluctant to say who they’re buying from today… or discussing your competitors at all. To defuse this, say something like, “We don’t want to develop a new product that bores you… because you can already get something like it today. So we’d like to benchmark against the best there is today… so we can bring you something better. Can you suggest who we should benchmark against?”

- Follow-up: As with Discovery interviews, strong follow-up to your interview is critical to ongoing customer engagement. At a minimum, a) discuss how you’ll keep them apprised of your progress as you move forward, and b) offer to send them a PDF copy of your interview notes. (To do this, click "Export to PDF" after your team has debriefed and cleaned up its notes.) Other good “touch-points” are vetting your side-by-side testing methods with them… getting their input on your product design concepts… and offering them early prototypes or samples.

For more on Preference interviews, see e-Learning Modules 23 and 24 (Preference Interviews A & B), both at www.blueprintingcenter.com > e-Learning. For more details on how AIM clients conduct Preference interviews, see Preference Interview Research Report.

Keywords: Preference interview, Preference interview logistics, suggestions for Preference interviews, how to measure outcomes, test methods in Preference interviews, Must Haves in Preference interviews, benchmark products in Preference interviews