Blueprinting is one of many tools to remove uncertainty on assumptions... and it fits within the Minesweeper framework.

Minesweeper project de-risking was originally developed to help Blueprinting teams that were pursuing new product development for unfamiliar markets. Blueprinting is effective in learning what those markets wanted and were not getting from incumbent suppliers. But it isn't as good at learning what those markets were already getting and wanted to keep getting. It’s common for unfamiliar markets to have unspoken needs being met by incumbent suppliers… that are not obvious to a challenging supplier.

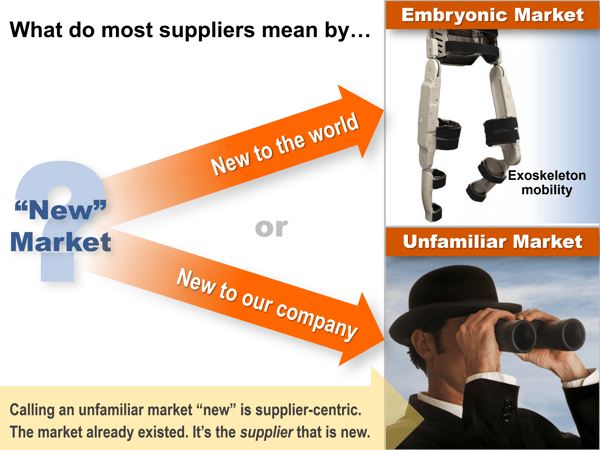

A quick note here: Why do we say “unfamiliar” markets instead of “new” markets? Most B2B markets are not truly new… in the embryonic, never-existed-before sense. Rather they are just “new” to the supplier trying to enter them. So you, dear supplier, may be “new,” but your market is not. So calling these markets “unfamiliar” is a less supplier-centric way of thinking. This is good news from a practical perspective: If your target market has existed for a while, its customers can explain their needs to you.

Today, Minesweeper project de-risking isn’t confined to new product development in unfamiliar markets. Companies use if for core, adjacent and transformational opportunities. And they use it for projects that don’t involve new products and services… for internal projects, for instance.

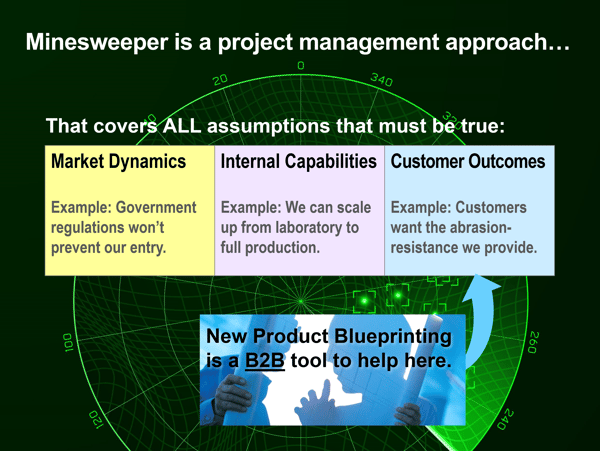

That said, new product development is still the most popular application of the Minesweeper approach, and the question often arises, “How do Minesweeper and Blueprinting fit with each other?” Think of Minesweeper de-risking as a larger project management approach that covers all assumptions that must be true for the project to succeed.

New Product Blueprinting is a tool that fits within that larger framework… specifically to understand customer outcomes in the target market. Not only that, Blueprinting is designed to understand B2B customer needs… when you are interviewing someone “in business.” If you use Minesweeper methodology for B2C—developing a product for end-customers—you’ll likely use different tools to understand their needs.

In terms of project timing, a team typically conducts a one-to-two day kickoff meeting using Minesweeper software. At the beginning, the team generates assumptions, and then isolates those that are high-impact and low certainty. The meeting ends with a CheckPoint plan that assigns each team member to investigate certain assumptions… essentially driving them from uncertainty to certainty.

Where does New Product Blueprinting fit? If it is used—and it doesn’t have to be—some team members conduct Discovery and Preference interviews with customers in the target market segment. These interviews will build certainty on two types of customer outcomes: 1) Required outcomes… those that customers in this market already get and want to keep getting. 2) Desired outcomes… those that customers would like to see improved.

If you are conducting Discovery interviews on a Minesweeper project, consider two adjustments to make. First, create a side-list of questions you can ask as opportunities naturally arise. These questions will be designed to increase certainty on your key assumptions. Second, be sure to probe well for what the customer is already getting from incumbent suppliers, especially those outcomes the customer considers "must have."

Keywords: Minesweeper framework, New Product Blueprinting, unfamiliar market, new market, embryonic market, core, adjacent, transformational, Discovery interviews, Preference interviews