1. Shortcomings of the Vitality Index (% of sales from new products)

Your Vitality Index is not predictive, prescriptive or precise. Consider supplementing it with other metrics.

Peter Drucker said, "If you can't measure it, you can't improve it." So what’s the “it”? Consider another Drucker quote, “The business enterprise has two—and only two—basic functions: marketing and innovation. All the rest are costs.” It’s not hard to imagine this great management thinker wanted us to measure innovation.

How do you measure new product innovation? Most companies today use a metric developed by 3M in 1988 called the Vitality Index. One of its attractions is simplicity: new product revenues as a percent of total revenues. “New” products are those introduced in the last five years (or sometimes three years.)

Should you keep using the Vitality Index? Absolutely. Should you stop relying solely on this three-decades-old metric? Is it time to apply innovation to how you measure innovation? You bet. The Vitality Index is helpful, but doesn’t “measure up” in three areas:

- Not predictive: The Vitality Index is a lagging indicator, only telling you what already happened. It leaves you clueless as to what will happen next. That would require a leading

- Not prescriptive: It doesn’t suggest how to improve. Want an impressive stream of highly-differentiated new products? Good luck getting any help from this metric.

- Not precise: It’s famously easy to manipulate. Want to call your product “new” because you changed its color... its packaging… or just its name? You won’t be the first.

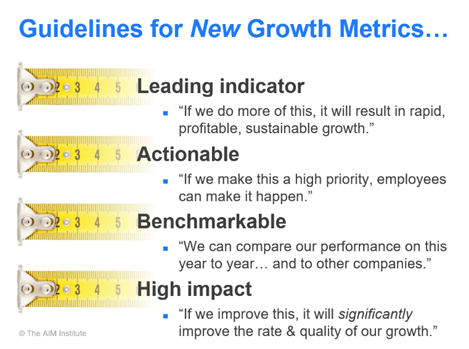

Imagine you were going to introduce new industry metrics for measuring innovation and ensuing growth. What criteria would you use? These four would be at the top of our list:

- Leading Indicator: “If we do more of this, it will result in rapid, profitable, sustainable growth from our market-facing innovation.”

- Actionable: “If we make specific activities a high priority, our employees will be able to implement them.”

- Benchmarkable: “We can easily compare our performance on this year over year… and against other companies.

- High impact: “If we improve these things, it will significantly boost the rate and quality of our growth.”

The AIM Institute has developed two new metrics which satisfy these criteria: The Growth Driver Index (GDI), and the Commercial Confidence Index (CCI). The first measures your growth capabilities, and the second your unfiltered customer insight.

For more, read the AIM article, Beyond the Vitality Index ... or download our white paper, New Innovation Metrics. Also check out the 2-minute video, Employ new growth metrics, part of the B2B Organic Growth video series by Dan Adams.

Keywords: vitality index, new product percent of sales, innovation metric, commercial confidence index, CCI, growth driver index, GDI