3. 2nd New innovation metric: Commercial Confidence Index (CCI)

This metric tells you if your R&D spending is focused on known customer needs... or assumed needs.

Most new products fail for commercial—not technical—reasons. Technical risk typically decreases during product development, but commercial risk often remains high all the way through launch. Companies figure out what customers want and don’t want by launching products at them.

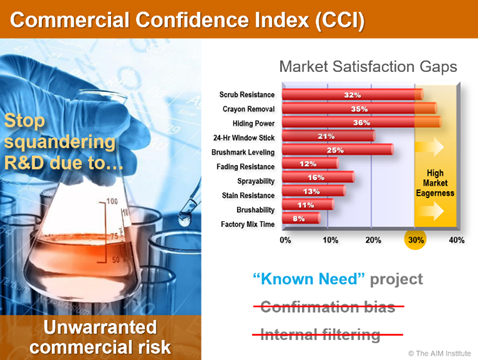

And yet with B2B customers—who have high knowledge, interest, objectivity and foresight—you can know what customers want in the front end of innovation. New Product Blueprinting practitioners interview customers, asking them to rate several outcomes on a 1-to-10 scale for both importance and satisfaction (during Preference interviews). As shown in this chart, this generates a Market Satisfaction Gap for each customer outcome. Customers are only eager for improvement if the Gap is over 30%.

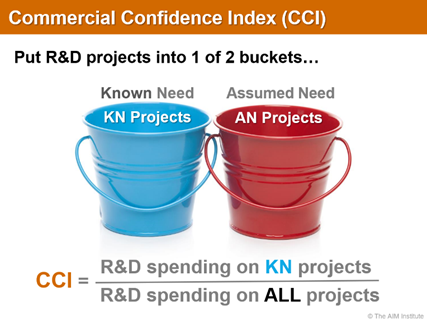

So how do you calculate a Commercial Confidence Index (CCI) for your business? You begin by putting all your new product R&D spending into one of two buckets: Known Need projects and Assumed Need projects.

If you are developing a product based on Market Satisfaction Gap data (or something equally rigorous), we call this a “Known-Need” (KN) project. Everything else is a “Assumed-Need” (AN) project. The Commercial Confidence is simply your R&D spending on KN projects divided by your total R&D spending.

Let’s try an example. Your R&D product development spending this year is $10 million. You have Market Satisfaction Gap data on four of these projects, each of which consumes $1 million of R&D. Your CCI is 40%.

We understand this is often a new way of thinking for many. Can you imagine the dialogue that occurs when you first introduce this?

- Comment #1: “But I have no idea what my CCI is!”

- Response #1: “So you’re not sure if customers want what you’re spending millions on?”

- Comment #2: “OK, I’ve figured out my CCI now, but it’s… uhmm… zero.”

- Response #2: “OK, but here’s my question: What will it be next year, and the year after?”

- Comment #3: “This is going to take extra resources to figure out Market Satisfaction Gaps.”

- Response #3: “Could you use resources now being wasted by guessing customer needs?”

Yes, this requires different thinking. But what else could massively reduce commercial risk in your portfolio of market-facing projects?

For more, read the AIM white paper, Market Satisfaction Gaps, and the AIM article, Beyond the Vitality Index ... or download our white paper, New Innovation Metrics. Also check out the 2-minute video, Employ new growth metrics, part of the B2B Organic Growth video series by Dan Adams.

Keywords: innovation metric, commercial confidence index, CCI, market satisfaction gap, known customer needs, assumed customer needs